Residential Energy Credit 2024 – It’s certainly not a time of year most Americans look forward to. But it might be a reason to celebrate if you made certain energy-related improvements to your home last year — like adding solar . The energy efficient home improvement credit can help homeowners cover up to 30% of costs related to qualifying improvements made from 2023 to 2032 .

Residential Energy Credit 2024

Source : southfacesolar.com2024 Federal Solar Tax Credit Guide | Solar Tax Credit Calculator

Source : www.solarreviews.comClean Vehicle and Residential Energy Tax Credits 2024 – What To Know

Source : www.linkedin.comSolar Tax Credit By State 2024 – Forbes Home

Source : www.forbes.comWhat to Know About Home Energy Tax Credits in 2024 Landmark CPAs

Source : www.landmarkcpas.comClean Vehicle and Residential Energy Tax Credits 2024 – What To

Source : www.crosslinktax.comHeat Pump Tax Credit 2024 – Forbes Home

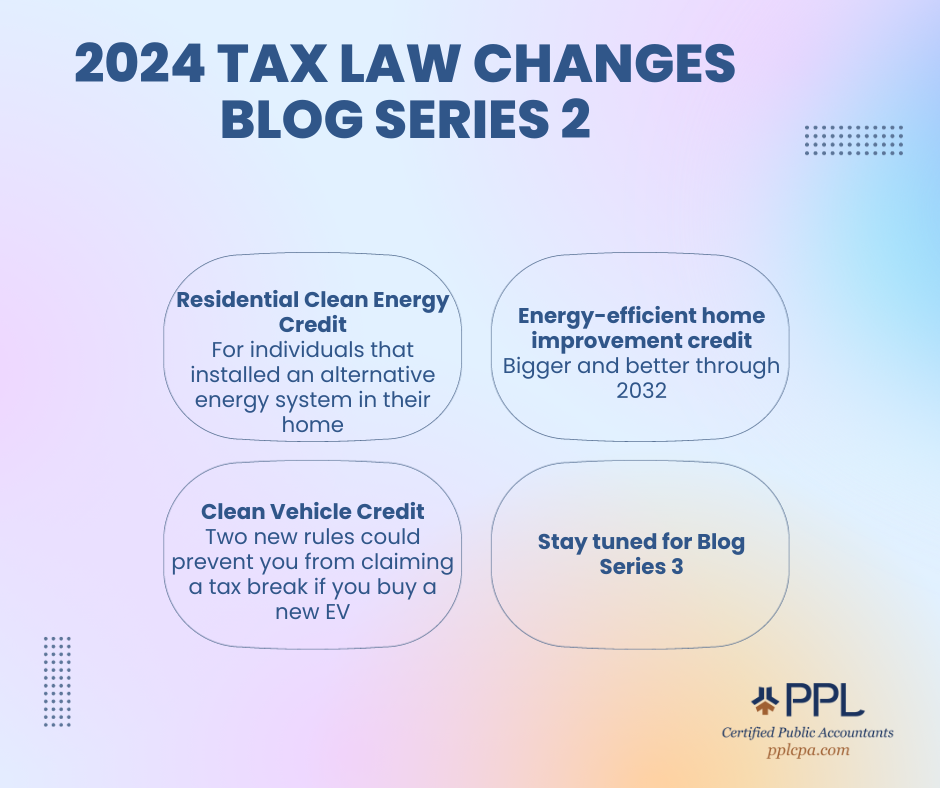

Source : www.forbes.comBlog Series 2: Tax Law & Updates for 2023 PPL CPA

Source : www.pplcpa.comSAFE HARBOR YOUR 26% SOLAR ITC – Staten Solar

Source : statensolar.comSolar Panel Tax Credit 2024: An In Depth Analysis

Source : www.solarinsure.comResidential Energy Credit 2024 How to Claim the Solar Tax Credit in 2024 | Arizona: The Archdiocese of Chicago recently made news when it announced its shift to 100% renewable energy. But did that mean the district installed solar on its nearly 400 parishes, schools and office . For people who don’t have solar installations, community solar farms offer environmental and financial benefits .

]]>