2024 Business Expense Deductions – You can start planning now for these two large expenses by following the tips below: Housing costs Housing expenditures increased 7.4% in 2022, according to the Bureau of Labor Statistics. Whether . Finance chiefs continue to hammer away at their companies’ expense lines despite a much improved economic backdrop and increased confidence that the U.S. economy has sidestepped a recession.In recent .

2024 Business Expense Deductions

Source : www.freshbooks.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

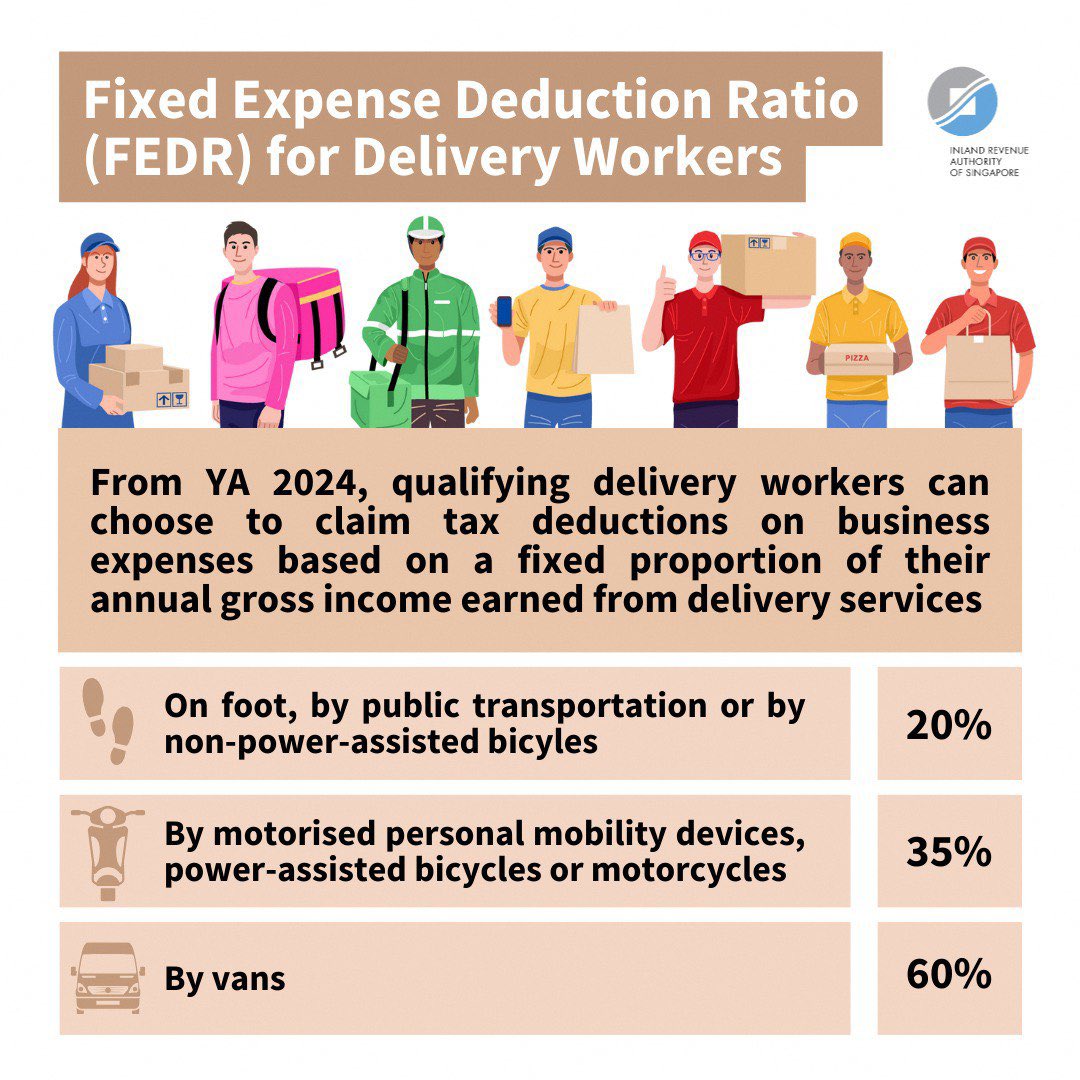

Source : quickbooks.intuit.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comDos and Don’ts for Business Expense Deductions – The Burns Firm

Source : www.theburnsfirm.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.com2024 Business Expense Deductions 25 Small Business Tax Deductions To Know in 2024: you can opt to itemize deductions for certain expenses, including things like property taxes, mortgage interest, business expenses, and interest paid on student loans. There are more ways to lower . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)