2024 Business Expense Deductions Available – You can start planning now for these two large expenses by following the tips below: Housing costs Housing expenditures increased 7.4% in 2022, according to the Bureau of Labor Statistics. Whether . We’ll explain general guidelines for available deductions and how individuals entitled to “both ordinary and necessary” business expenses related to his drug-dealing activities. .

2024 Business Expense Deductions Available

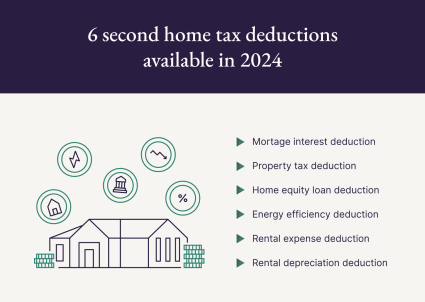

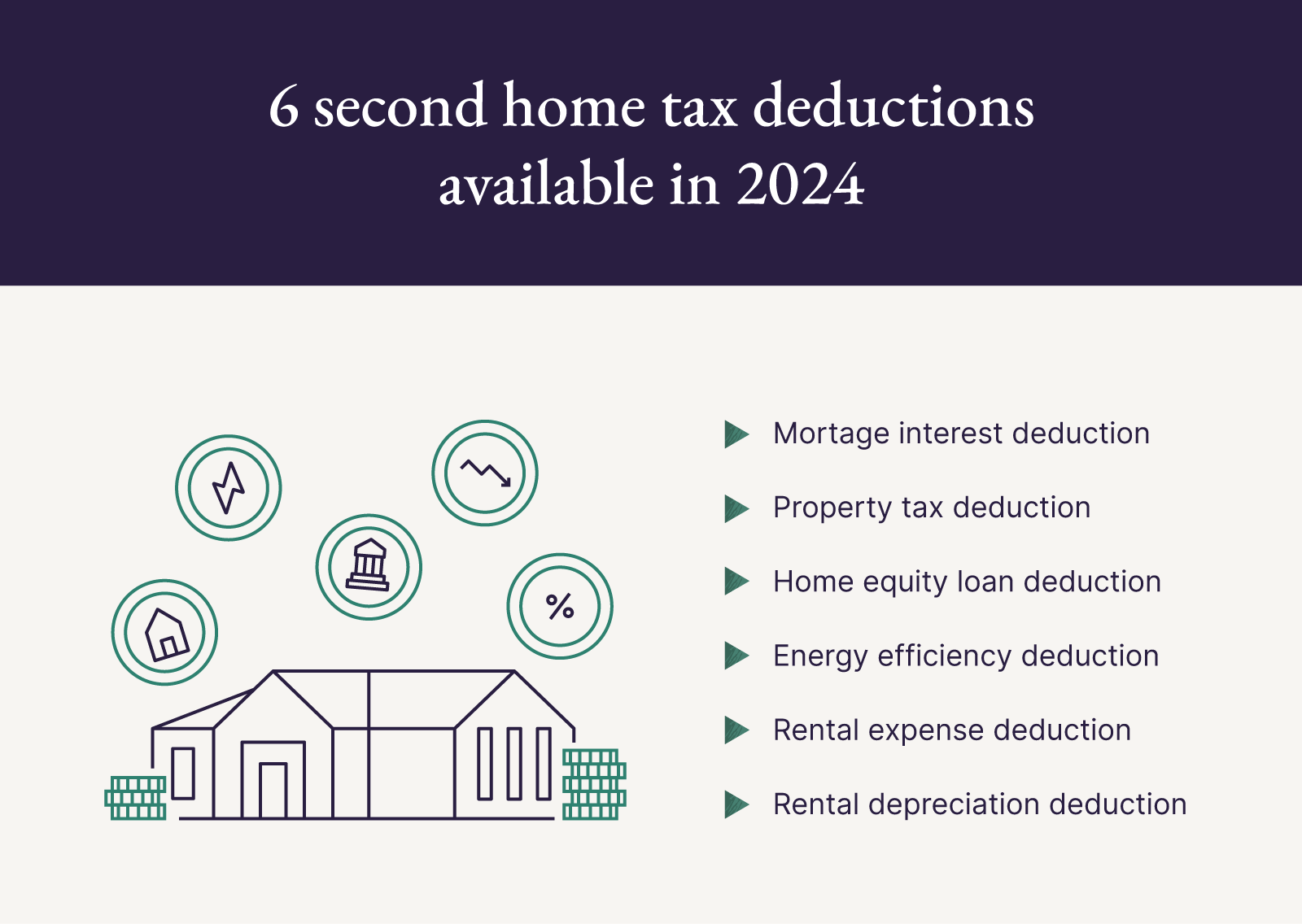

Source : www.freshbooks.com6 Second Home Tax Deductions to Claim in 2024 Pacaso | Pacaso

Source : www.pacaso.com2024 State Business Tax Climate Index | Tax Foundation

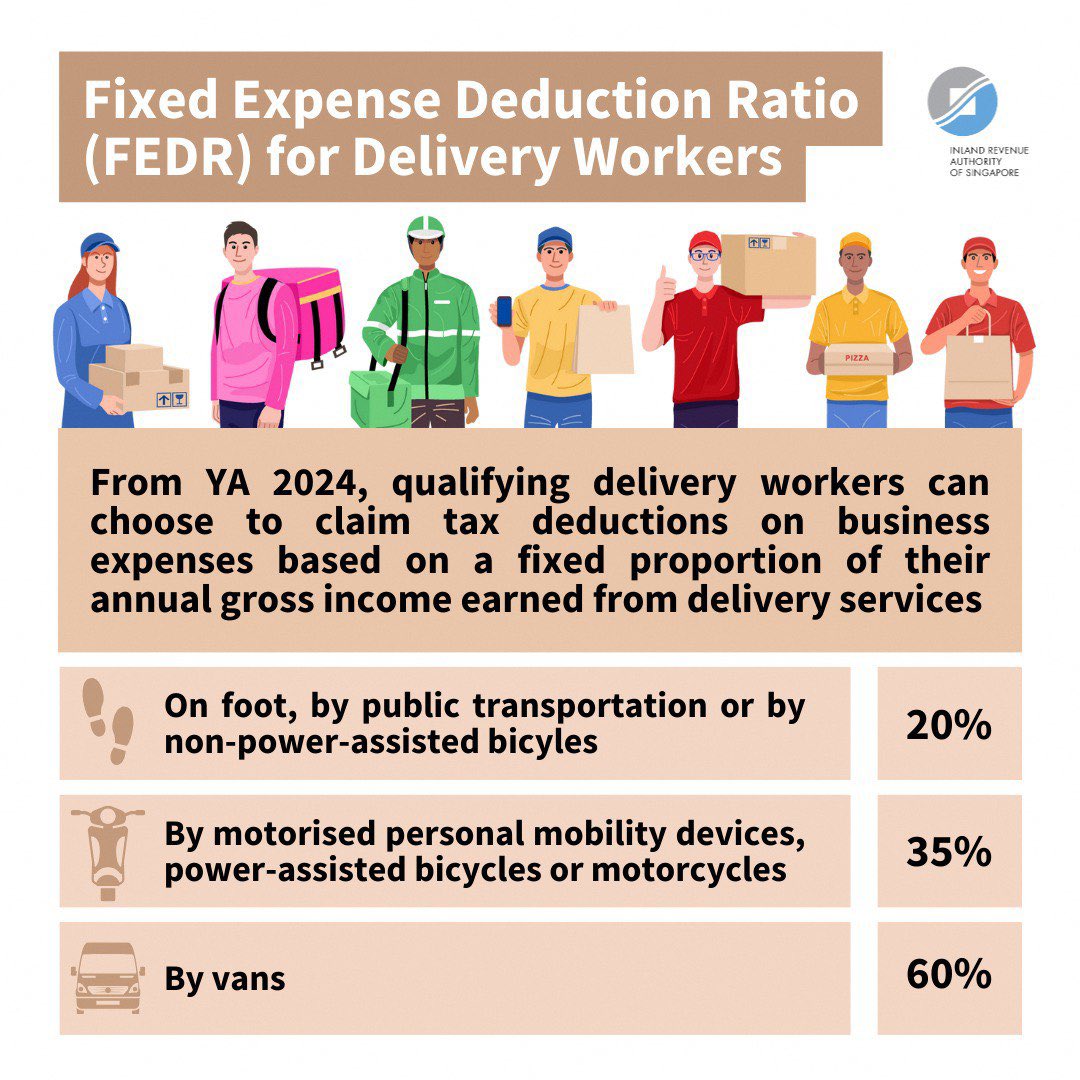

Source : taxfoundation.orgIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com6 Second Home Tax Deductions to Claim in 2024 Pacaso | Pacaso

Source : www.pacaso.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comE4 Bookkeeping & Taxes

Source : www.facebook.com2024 Business Expense Deductions Available 25 Small Business Tax Deductions To Know in 2024: QuickBooks® Online Best app for employees’ business expenses: Expensify Free for 20 total envelopes; $8/month (or $70/year) for unlimited envelopes Who’s this for? When you’re just starting out . Small businesses facing economic hardship from January’s Arctic blast may be eligible for relief, Portland Mayor Ted Wheeler, and Commissioner Carmen Rubio announced Tuesday. .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)